Real estate has long been considered a reliable avenue for wealth-building. While most people are familiar with a few aspects of how real estate can generate income, there are actually five key ways in which owning a house can build wealth. In this blog post, we’ll explore all five of them and shed light on the often overlooked strategies that can help you maximize your real estate investments.

Five Ways to Build Wealth with Properties

- Cash Flow

- Appreciation

- Depreciation

- Tax Reduction

- Principal Paydown

Cash Flow

Cash flow is perhaps the most obvious way to generate income from a house. It’s the difference between the monthly income a property generates and the expenses related to it. For example, if your mortgage, insurance, and other expenses total $2,000 per month, but your property brings in $2,500 in rent, you’re left with a positive cash flow of $500 each month. This steady income stream is a fundamental aspect of real estate investing.

Appreciation is the increase in a property’s value over time. While appreciation rates can vary by location and property type, historically, real estate has appreciated at an average rate of around 4.2% per year. This means that your property’s value can increase significantly over the long term, contributing to your overall wealth.

Depreciation

Depreciation is a tax benefit that allows property owners to write off the cost of their property over a specified period, typically 27.5 years for residential properties. This tax deduction can help reduce your taxable income, ultimately saving you money on your annual tax bill. Additionally, there are advanced strategies like cost segregation that can enhance these benefits as you delve deeper into real estate investing.

Tax Reduction

Real estate ownership offers various tax benefits beyond depreciation. You can also write off the interest on your mortgage, as well as expenses related to property maintenance and repairs. These deductions can significantly reduce your overall tax liability, allowing you to keep more of your rental income.

Principal Paydown

While many real estate investors focus on cash flow, they sometimes overlook the fact that with each mortgage payment, a portion goes toward paying down the principal balance. Over time, this builds equity in the property. Making extra payments each year can accelerate this process, potentially shortening a 30-year mortgage to as little as 22 years.

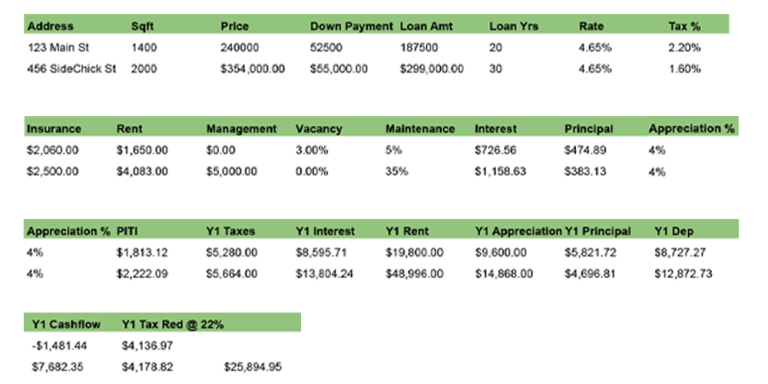

property value Financial Spreadsheet

Putting It All Together

To effectively harness the wealth-building power of real estate, it’s essential to have a clear understanding of all these factors and how they interplay. You can create a detailed spreadsheet that factors in variables such as property expenses, rental income, interest rates, and more. This spreadsheet can help you project your financial position over the life of your investment, taking into account fluctuations in interest rates and changes in property value.

Conclusion

Real estate can be a powerful tool to build wealth, but to make the most of it, you need to understand all the ways it can work in your favor. Cash flow, appreciation, depreciation, tax reduction, and principal paydown are all essential components of a successful real estate investment strategy. Continually educating yourself about the market and adapting your approach to changing conditions is key to achieving long-term success in real estate investing. If you’re an investor or aspiring to become one, don’t hesitate to share your strategies and experiences to contribute to a broader conversation about wealth-building through real estate.

Whether you’re a prospective first-time homeowner or a savvy renter, this video offers a treasure trove of knowledge to navigate the intricate crossroads of buying and renting.

If you want more information schedule a meeting with us! https://calendly.com/texastom/15min