I get a lot of folks that are interested in buying their first investment property which is fantastic! Most want to know where to start so I want to share some of what I’ve learned over the years. We will be looking at an example from a neighborhood in Keller Texas.

How Much Money Do I Need for an Investment Property in Texas?

Most people start with this. If you are going the traditional route a minimum of 20% down is going to be required. So for a $200,000 home, you are looking at $40,000 if it’s a real rental property and not traditional. For multifamily properties it may be a minimum of 25%.

What Price Range Should I Buy in?

This is a loaded question. We will get into numbers here in a minute. The first question I would ask is who you want your renters to be. If you are renting to someone paying $900/month their idea of cleanliness and home care is probably much different than someone who is paying $1,700/month or $2,400/month. Think of who your ideal renter would be. You’ll want to make sure your renter makes at least 3x your monthly rent. For example, a $1,700/mo renter needs to make at least $5,100/month. That’s someone who is making at least $60,000 per year.

The Numbers

We are going to take a look at a neighborhood in Keller Texas for this example. Rental properties are a long term investment. If you are looking for a short term investment it’s definitely possible especially if you use the brrr model. That’s a post for another day. There are a few rules out there that you will hear such as the 1% rule that says you want your rent to be 1% of the price of the home. So on $150,000 home you would charge $1,500 per month. This is very difficult to do in the Dallas / Fort Worth market now. I won’t say impossible but improbable with typical investing.

You need to decide what number you are comfortable with cash flowing and if this is a long term investment to where in 15-30 years when it’s paid off you have a passive income or if this is a shorter investment to where you’re gaining equity and plan to sell in 5-10 years.

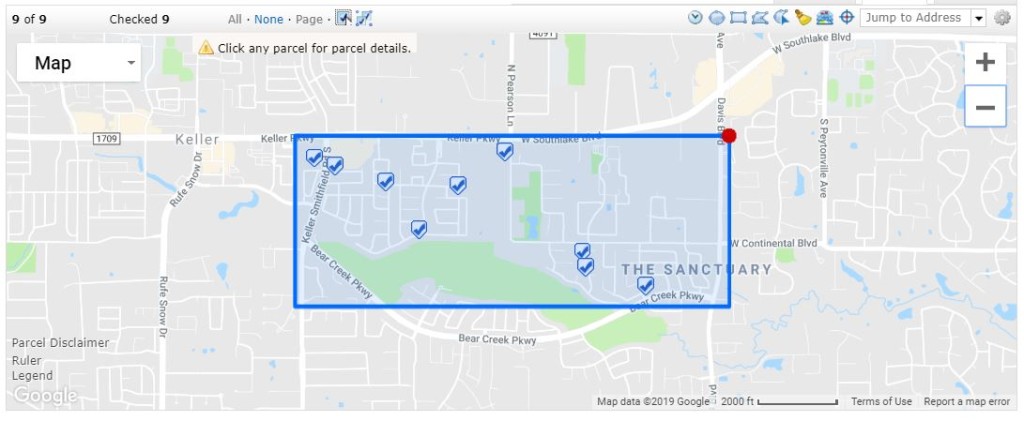

I’ve picked a random neighborhood in Keller to take a look at. Here are the criteria I’m using in my search

- Less than 3,000sqft

- Pre existing home (cost will be lower)

- Rental comps within a year

- Home sales within 6 months

I would also suggest filtering out properties with pools. They are extra maintenance and don’t provide a positive ROI. This shows the area I’ve selected.

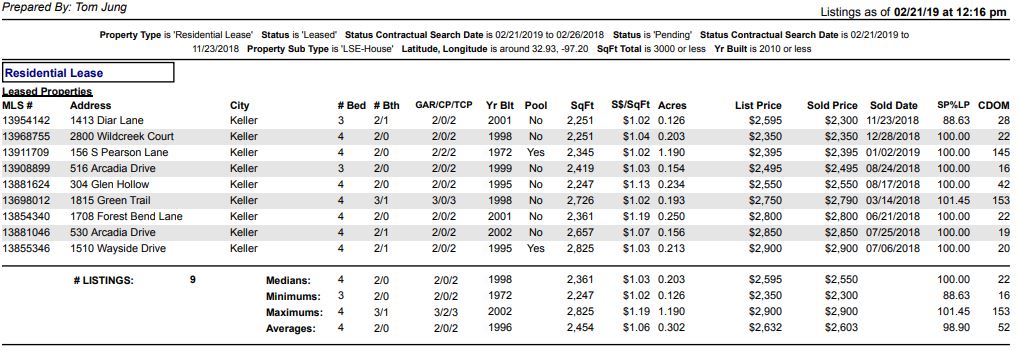

First let’s look at the rental rate. Our median rental price per square foot is about $1.03

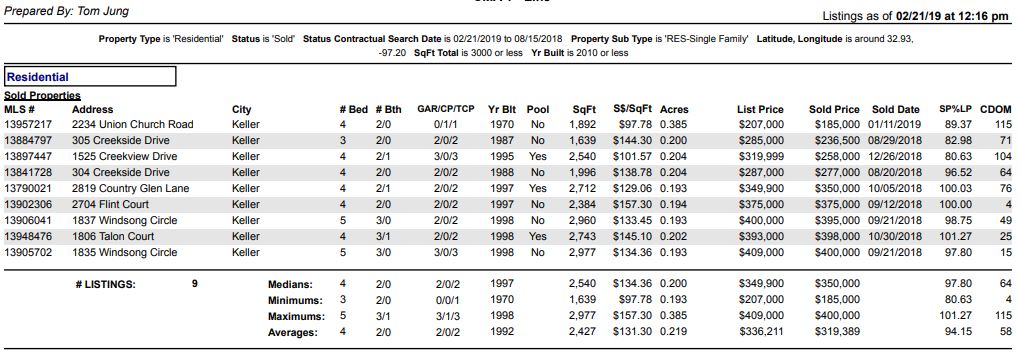

Now lets take a look at our purchase prices in this neighborhood. Our average price per square foot is about $131 for 2400sqft

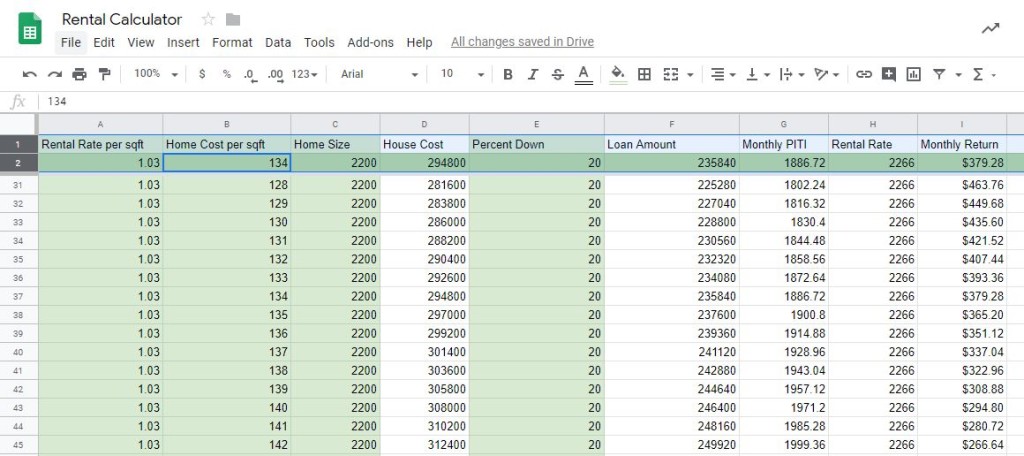

Now that we have a rough idea of what our numbers are, let’s plug it into our handy dandy spreadsheet. This is a tool I use to quickly analyze if the neighborhood is a good spot. Of course all of these numbers change based on what you buy the house at, the house size, rental rate and your interest rate.

This example is to evaluate a neighborhood and determine if it’s in our comfort range. When we find a house we will detail the numbers. So if we tweak just a couple of things we are in great shape here. If we can buy the house at a little bit lower cost per square foot. Say $130 and if we buy a house that’s around 2200 square feet we should be able to cash flow about $435 per month.

Maintenance and Interest

It’s important to factor in Maintenance cost. If you are looking to buy a home, roof age and HVAC age is important along with items that require maintenance such as wood exterior siding, type of plumbing, insulation and more. Interest is also huge if you look at your amortization schedule. I’d suggest setting aside a portion of your funds for maintenance and putting the rest towards principle. The sooner you pay it, the sooner you have solid passive income.

This is just the tip of the iceberg when it comes to investing. If you have any questions please don’t hesitate to reach out! Knowledge is free here =)